NFT Comeback 2026? Why Polymarket and Prediction Markets Are Surging Amid Economic Pressure

Greetings Warriors!

I’ve been watching the timeline lately and it feels like we’ve entered a new era of modern survival behavior. Not survival like “hunt mammoth.” Survival like “rent is due, groceries cost a kidney, my group chat is stressed, and now people are trading probabilities on the Super Bowl halftime show.”

And in the middle of that chaos, we’ve got something weirdly fascinating happening:

NFTs are so down bad that people are literally betting on their comeback on platforms like Polymarket.

Prediction markets are exploding in attention and volume—Kalshi reportedly hit about $1B in trading volume on Super Bowl Sunday.

Even Robinhood’s CEO is out here calling it a possible “prediction market supercycle.”

Meanwhile, the global economy is “steady” on paper… but the lived experience is still tight, expensive, and uncertain. The IMF projects ~3.3% global growth in 2026, with inflation easing, but a lot of people still feel squeezed.

So today we’re going to talk about what’s really going on:

The resurgence of NFT betting narratives (and why Polymarket matters)

The overall increase in betting / prediction markets globally

The real reasons people are piling in

The economic backdrop—and why betting feels like “relief” to some people

The uncomfortable truth: when “relief” becomes a trap

Let’s get into it.

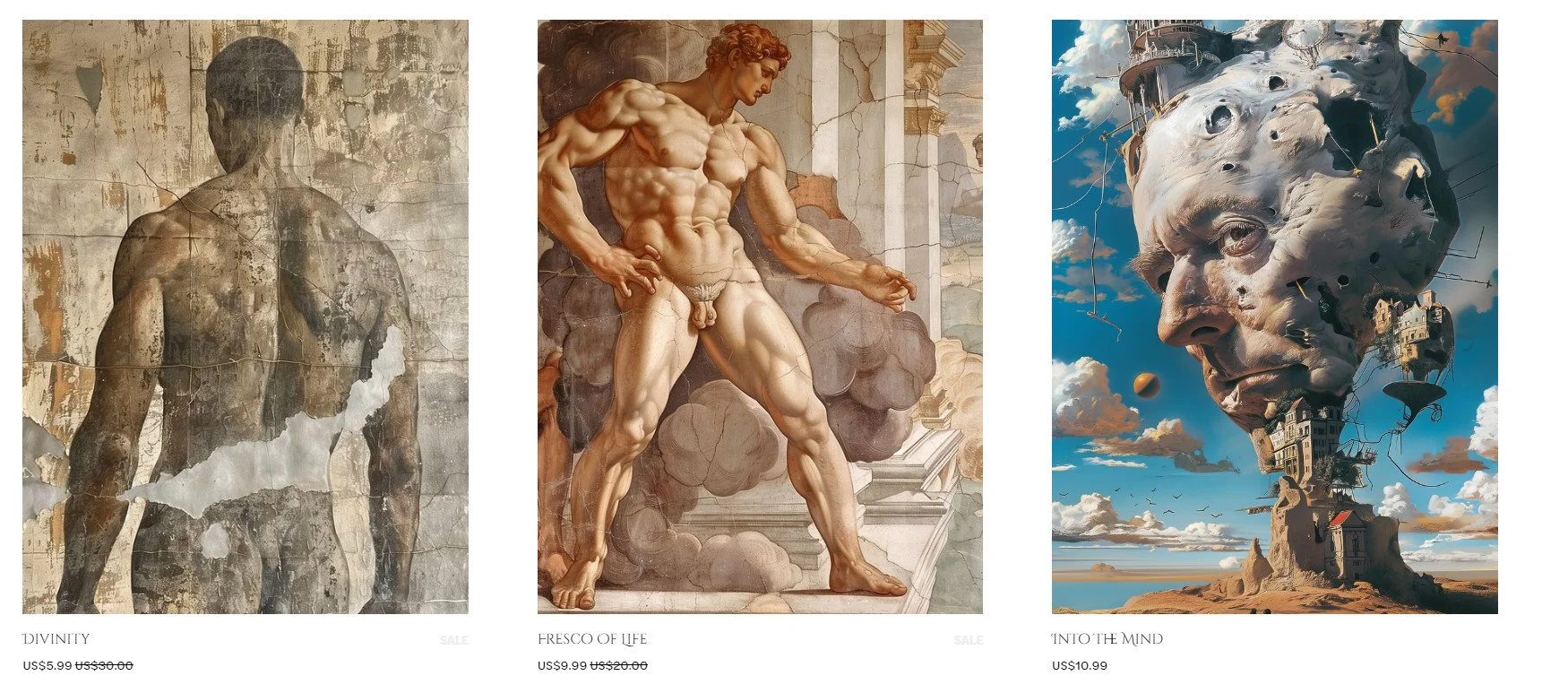

Check out my new poem book!

A collection of my most deepest thoughts.

The NFT Comeback Bet: When Hope Gets Financialized

NFTs had their boom. Then they had their “winter.” Then they had their “are we dead forever?” moment.

Now we’re seeing a new chapter: people betting on the narrative itself.

On Polymarket, traders pushed the implied odds of an NFT comeback in 2026 to about 65%, with reporting noting over $1.12M in the contract around mid-January 2026.

That’s important because it signals something deeper than “NFTs are back”:

It means the market is trading sentiment as an asset. Not just JPEGs. Not just floor prices. But the belief that the world might care again. And Polymarket isn’t alone—prediction markets have become the new coliseum where people place money on the future and call it “information.”

Get two custom AI Art created by yours "King Romulus" truly every month. Uniquely crafted, with expressive quotes that dive deep into my subconsciousness. One of the art pieces will be posted on my Instagram account as well. Live through art history in the making!

Betting Markets Aren’t Just Growing—They’re Mutating

Traditional sports betting has been growing for years, powered by legalization, mobile apps, and nonstop marketing. But prediction markets are a different beast.

They don’t feel like a sportsbook.

They feel like trading.

They look like finance.

They talk like finance.

And that makes them emotionally easier to justify. One of the clearest “we are not in Kansas anymore” moments: Kalshi reportedly hit over $1B in trading volume on Super Bowl Sunday—with a ton of activity tied to entertainment outcomes. That’s not niche. That’s cultural. And then you’ve got Robinhood’s CEO publicly framing prediction markets as potentially entering a “supercycle,” with major global events (like Olympics / World Cup) acting as fuel.

Translation: the industry is trying to turn “watching the world” into “trading the world.”

Why Betting Is Rising: The Real Reasons (Not the PR Reasons)

Let’s keep it honest. People aren’t piling into betting markets because they suddenly love math.

They’re piling in because:

A) It’s frictionless now

It used to be: drive somewhere, place a bet, wait.

Now it’s: thumbprint → trade → dopamine.

And prediction markets make it even easier because they feel like “I’m just taking a position.”

B) It feels like control in an uncontrollable world

When the world is unpredictable, the human brain starts hunting for handles.

“Let me bet on something. Let me forecast something. Let me be right about something.”

Prediction markets sell that illusion beautifully: a number, a probability, a chart, a “Yes” or “No.”

C) Entertainment + finance finally merged into one monster

You can bet on sports. You can bet on award shows. You can bet on celebrity outcomes.

There was even public reporting about disputes involving prediction markets around a Super Bowl halftime cameo—because even defining reality becomes part of the gamble.

D) People are broke-tired

Let’s not play games:

A lot of people feel like the cost of living rose faster than their paycheck, and they’re stuck in the gap.

Which brings us to the economy.

The Economy: “Steady” on Paper, Heavy in Real Life

The IMF’s January 2026 update projected global growth around 3.3% in 2026 and noted inflation continuing to cool globally. The OECD also projected inflation easing in the G20 through 2026–2027.

So why do people still feel like they’re in a pressure cooker?

Because “inflation easing” doesn’t mean prices go back down.

It means they rise slower. And borrowing costs still matter. In the U.S., the Fed’s target range has been around 3.5%–3.75%, with officials signaling patience about cuts.

So for a lot of households, it’s this vibe:

expenses are still high

debt is expensive

job security feels fragile

“steady growth” doesn’t feel like my life is steady

And in that environment, betting markets start to look like something else:

Not “fun.”

Not “sports.”

But a coping mechanism.

Vosoughi, I Am The Light! - 2025

How Betting Feels Like Relief (And Why That’s Dangerous)

Here’s the truth nobody wants to say out loud; betting can feel like a shortcut out of stress. When money is tight, the fantasy of a win is powerful.

When life feels stagnant, the thrill of “maybe tonight changes everything” hits like a shot of electricity. That’s exactly why these platforms scale.

Because they don’t just sell outcomes.

They sell hope with a price tag.

And when hope is scarce, people will pay.

The “soft pitch” version:

“It’s just a small bet.”

“It’s entertainment.”

“It’s research.”

“It’s probability.”

The real psychological version:

“This makes me feel alive.”

“This makes me feel smart.”

“This makes me feel like I still have a shot.”

That’s not an insult. That’s human. But we have to say the other part too:

Betting is not a financial plan. It can ease emotional pressure temporarily, but if it becomes routine—especially in hard economic times—it can compound the burden. So if you’re reading this and you’ve felt that pull, Warrior, I’m not judging you. I’m just calling it what it is.

The NFT Angle: Why NFTs and Betting Markets Make Sense Together

NFTs have always been half art, half casino.

speculation

hype cycles

community narratives

“blue chips”

“comeback season”

So prediction markets are basically the next logical step:

Instead of buying the NFT, you can bet on the idea of the NFT sector recovering. And that’s why that Polymarket “NFT comeback” market is so symbolic. Because it shows the space maturing into something colder:

From owning culture → to trading sentiment about culture.

It’s Wall Street behavior with Web3 aesthetics.

What This Means Going Forward

Here’s what I think we’re walking into:

Prediction markets will keep expanding. Big events drive volume. Platforms will keep adding markets. Finance apps will keep integrating.

They’ll become a new “signal” people cite. Just like people reference polls, they’ll reference odds. “Polymarket has it at 65%.” (As if the number itself is truth.)

We’ll see more controversies over “resolution”. Because when you bet on reality, you also have to define reality. The economy will keep shaping behavio’. As long as people feel financially cornered, high-risk hope will remain attractive—even if the macro charts look “fine.”

Warrior Take: Don’t Let the Algorithm Sell You False Salvation

I’ll end it like this:

If betting markets are rising, it’s not just because technology improved. It’s because modern life has become a pressure test. And when people are under pressure, they look for relief—any relief.

Sometimes that relief is art.

Sometimes it’s community.

Sometimes it’s faith.

Sometimes it’s the gym.

And sometimes… it’s the glowing promise of a “Yes” contract at 65% odds.

Just remember:

Hope is holy.

But hope can be exploited.

So if you play in these markets, play like a warrior:

Set strict limits.

Never chase losses.

Don’t confuse excitement with strategy.

And if it stops being fun, step back immediately.

Your peace is worth more than a win.